- Chinese Investments in Israeli Mobile, Media, Cyber and Medical Startups

By Yoav Sadan December 20, 2016

In our first article in these series about Chinese investments in Israeli tech, we gave some basic tips for all you Israeli tech entrepreneurs aiming at China. After that we took a deeper look at how investments and acquisitions can vary, and guide you through the market. If you haven’t read them, feel free to check them out. Now we’re going to dive deeper and examine major investment verticals from 2010- 2016 and several key VC’s. The whole purpose is to give you better tools to understand how the Chinese investment in Israel looks right now.

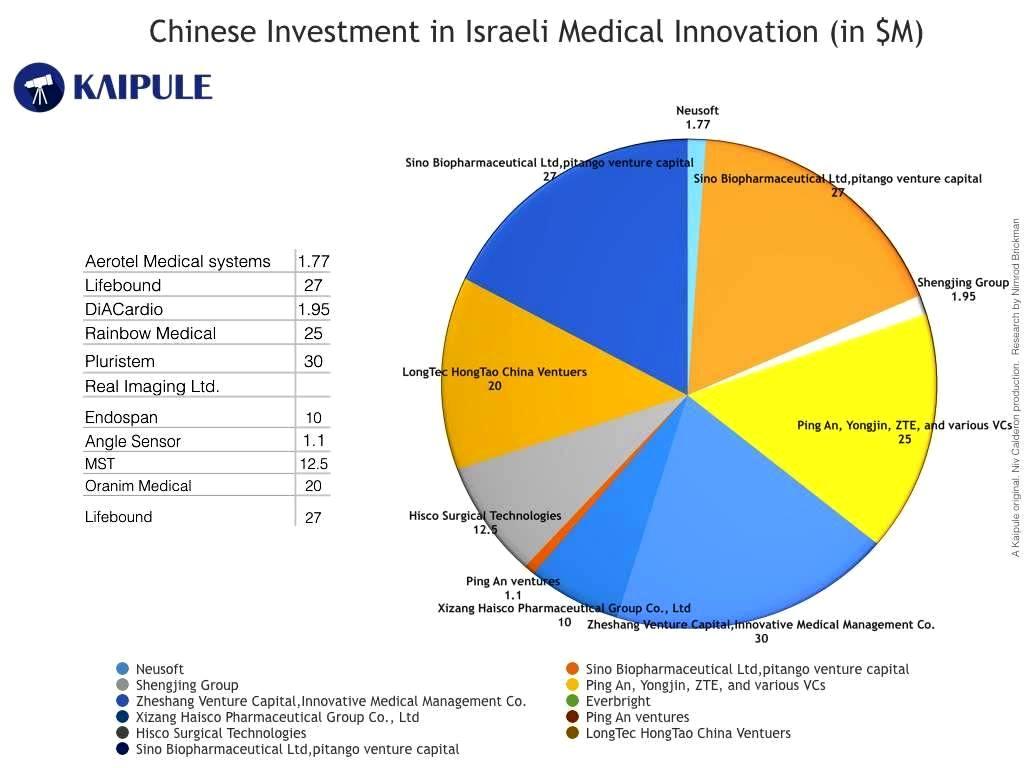

Let’s start with medical. Clearly the largest invested and acquired area of them all.

Investments in that time reached $150M, and $750M in acquisitions . As with our last article , it’s important to understand the difference between acquisitions and investments in medical. Though acquisitions are three times bigger, they spread across just two companies. The thing to look for is diversification. Alma Lasers was bought in 2013 by Fosun Farma , two years later Lumines was bought by the XIO group , both laser device companies. we see even more similarities when we look at invested Israeli companies. Out of 10 companies, a great majority are bio-medical devices, and 3 were cardiac solutions. More than that, we see Ping-An Ventures that has invested in a heart monitoring bracelet , and other medical devices . By the way things are looking now, The Chinese investment world is looking in Israel for patentable medical devices.

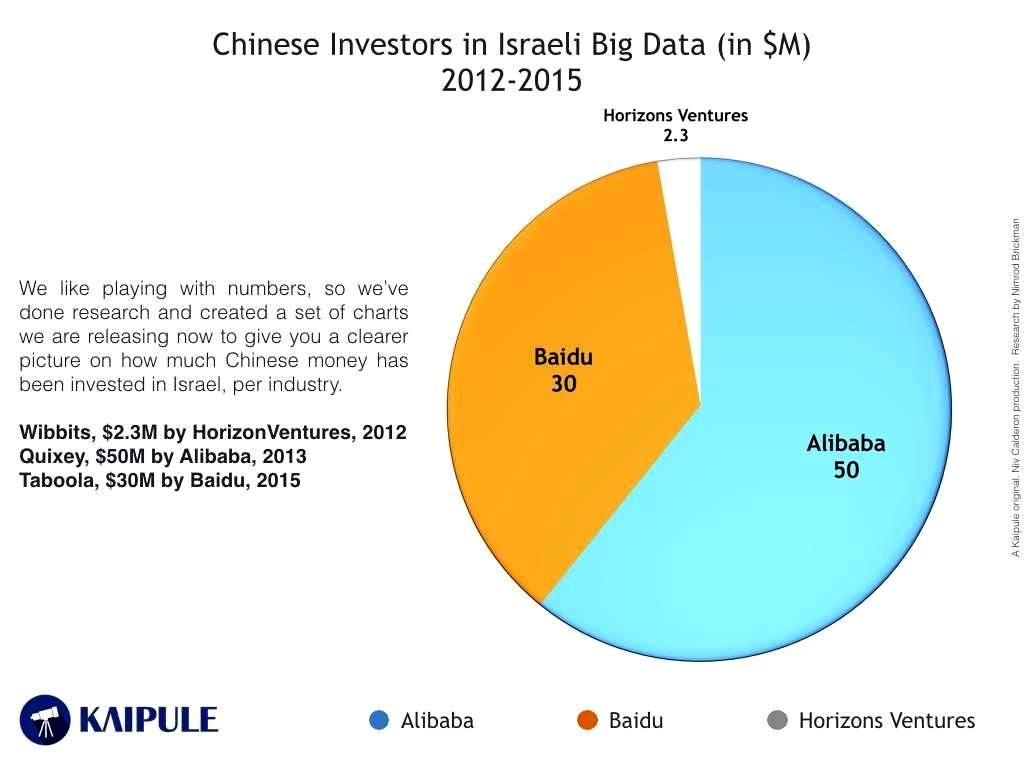

Let’s move over to big-data. With $82M in shared investments, Baidu and Alibaba are the key players. Although the Alibaba group recently started partnering with Israeli Incubators , they’ve still invested $50M in Quixey -, an app search engine . Baidu’s $30M investment was followed a few months later in Taboola – a content recommendation company. Though both Israeli companies aren’t fully overlapping, we’re starting to see a trend by the two Chinese giants to compete in the big data arena.

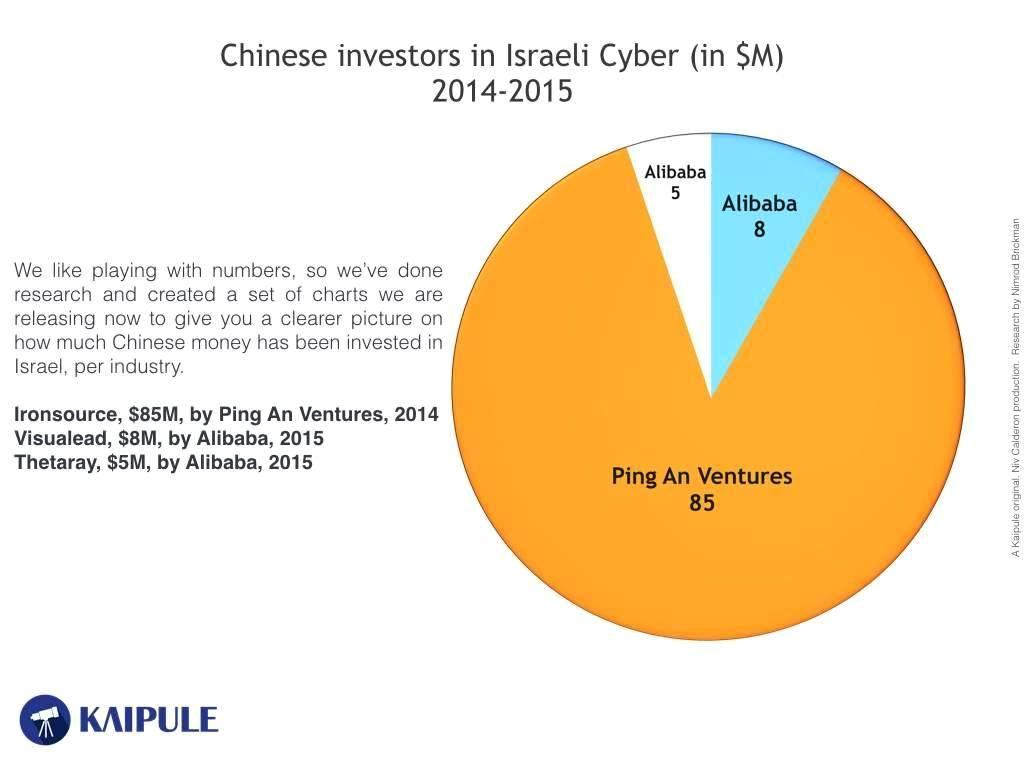

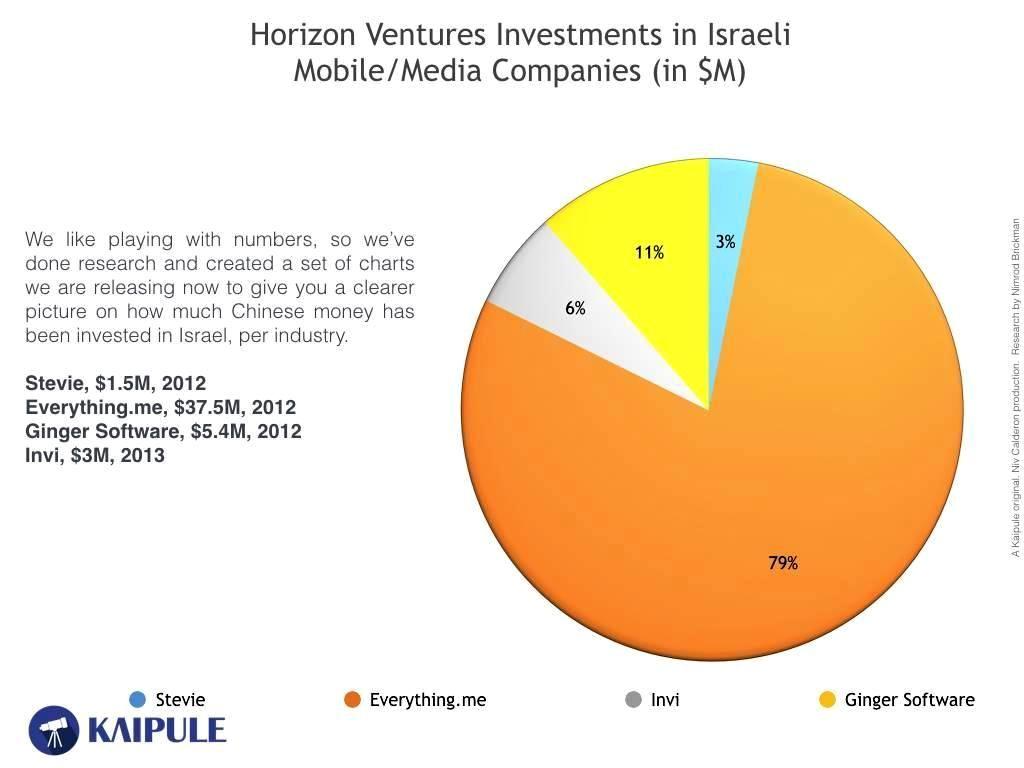

Now let’s take a look at the dominant Chinese VC’s and their actions. If you only look at the numbers, the XIO Group and Fosun Pharma are the largest players around, due to their huge acquisitions in medical. But when it comes to number of companies invested, Pingan and Horizons venture invested in the widest variety of companies and fields. Between 2010 and 2015, Horizons invested $240M in 18 different companies, ranging from ocean monitoring , finance and cyber security . Pingan Ventures invested in only 4 companies, but pulled in $85M in Ironsource . The thing to notice here is the difference in investments strategies at the time being.

From where we understand from the numbers, “ Horizons ” are spreading their funds through a much wider variety, but with significantly less funds per each vertical and company, while Pingan are much more specific to the web arena, with a much larger investment in average.

The thing to stress the most is that the actions of invested companies are correlated and overlapping. This gives you a much better understanding on how things are looking from “ both point of views ”.

– – –

公安部备案号 37010102000609

公安部备案号 37010102000609